British Tax Records

14

14Apr

Taxes are on everyone’s mind at this time of year! The practice of levying fees on the citizenry to pay for the government is a tradition as old as time. In the past, there were some creative ways of taxing the people of Great Britain. These records can serve as a census substitute for the eighteenth and nineteenth centuries by providing evidence of residency, social status, and inheritance. Let’s take a look at some of the taxes collected in the past, and the records they generated for our research today.

Hearth Taxes

In 1662, King Charles II was restored to the throne of England after eleven years of Commonwealth governance. The coffers were in need of replenishment, so Parliament introduced legislation to levy a tax on the number of hearths in a home.[1] This was easier than taxing individual people; hearths stayed in one place, while people tended to move about. A tax of two shillings per year was levied on each hearth in a home, but this was deemed to be a hardship for poorer people. The tax was amended to exclude paupers who had only one hearth or stove in their house.

The affluent members of society were greatly impacted by the Hearth Tax.[2] Large manor homes could have had dozens of hearths to heat their expansive interiors. Some property owners resorted to stuffing up  their chimneys, rendering the hearth or stove temporarily useless until the inspectors finished their assessment. This was risky because the tax was doubled if this ruse was discovered. Hearth taxes were collected regularly until James II was deposed by William and Mary of Orange. The hearth tax was repealed in 1688, in favor of other, equally unpopular means of taxation.

their chimneys, rendering the hearth or stove temporarily useless until the inspectors finished their assessment. This was risky because the tax was doubled if this ruse was discovered. Hearth taxes were collected regularly until James II was deposed by William and Mary of Orange. The hearth tax was repealed in 1688, in favor of other, equally unpopular means of taxation.

Ireland also imposed a hearth tax, beginning in 1689 and continuing until the 1800s.[3] These taxes were a crushing burden on the poor, and resulted in an innovative modification in basic architecture. Humble dwellings were constructed with no hearth at all. Fires were simply built right on the floor beneath the chimney.

Hearth tax records can be found for many parts of England and some parts of Ireland. Heads of household are included on the Hearth Tax records, along with the number of hearths, the amount of tax assessed, or an exemption if the property occupier was not required to pay the tax. While there is limited genealogical information in the tax records, they can serve as a census substitute by providing evidence of a head of household living in a specific place during a specific year.

Some collections of England’s Hearth Tax records can be found online at Find My Past or FamilySearch, or in book form at the FamilySearch Library and the National Archives of the United Kingdom. Fewer records exist for Ireland, but a search for “Hearth Tax Rolls” in Irish County records will show if these documents are available.

Window Taxes

In the late 1600s, “coin clipping” (the practice of shaving or trimming the edges of metal coins) was a widespread problem. Over time, a determined coin clipper could save the tiny amounts of shaved metal, melt it together, and cash it in with the local assayer. The illegal removal of bits of metal from coins caused devaluation of the currency of England and Wales.[4]

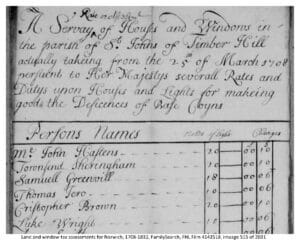

A remedy for this was introduced as another ingenious method of taxation: a tax on windows. Beginning in 1696 and continuing for 150 years, citizens of England, Wales, Ireland, Scotland, and even France were charged a tax on the windows in their home, specifically to make up for the revenue lost by the clipping of money.[5] The Window Tax had an enormous effect on the upper class, because their homes had many windows. Houses with ten to fourteen windows were taxed starting at six pence annually, and houses with more than fourteen windows paid nine to twelve pence. This led many homeowners to brick up some of the windows in their houses to avoid paying the tax.

The unpopular Window Tax was not repealed until 1851, after doctors and health organizations successfully argued that a lack of light and fresh air led to poor health issues.[6] Old homes with blocked or bricked windows can still be seen in Great Britain today. Many digitized records for Window Tax assessments can be found online at FamilySearch. The individual County Record Offices of England and Wales may also have window tax records. Searches can be requested for a small fee.

Land Taxes

One of the earliest forms of income tax was introduced in England as a Land Tax in 1692, and was not repealed until 1963.[7] Three centuries ago, taxes were assessed based on what the property would produce. Farmers sold fruits and vegetables or milk and eggs, and shopkeepers sold household goods, shoes, and other items. Land taxes were assessed “four shillings on the pound,” which meant for every pound of revenue generated from the property, the occupier would pay four shillings.

Not everyone paid this tax; poorer parishioners were exempted if the tax was a hardship.[8] If your ancestor did pay the Land Tax, the assessment records are useful for placing him in a specific parish, and because these records were kept annually, it is possible to track an ancestor from year to year. They can be useful for determining when a family moved into or out of a parish, and can be an indicator of inheritance if the property passed from one generation to the next. Assessment amounts can be compared between neighbors to determine economic status. In addition, Land Tax Assessments were used between 1780 and 1832 for establishing electoral rights. These records are usually found with the Quarter Sessions court documents at each County Record Office, and many are found online at Find My Past and FamilySearch.

Hearth, Window, and Land Tax Assessments do not include a great deal of genealogical value, but they are useful for verifying residency, indicating social and economic standing, tracing movements, and adding some interesting dimension to your family history. Our expert genealogists at Price Genealogy use these records and others to trace your ancestry. We look forward to assisting you with your research!

Patti

1 “Hearth Tax,” Wikipedia, rev. 24 June 2022, at 00:13 (UTC).

2 “Hearth Tax,” Wikipedia.

3 “Ireland Taxation,” article, FamilySearch Wiki (https://familysearch.org/en/wiki : accessed 5 December 2022), 5 December 2022, at 17:36.

4 “Window Tax,” article, Wikipedia (http://wikipedia.com : accessed 4 Nov 2022), rev. 24 October 2022, at 19:46 (UTC).

5 Ibid.

6 “Window Tax,” article, National Archives UK (https://www.nationalarchives.gov.uk/ : accessed 5 November 2022), Education > Classroom Resources > Georgian Britain > Window Tax.

7 “Cheshire Land Tax Assessments, 1786-1832,” webpage, Find My Past (http://www.findmypast.com : accessed 30 November 2022.

8 “Land Tax Assessments,” article, FamilySearch Wiki (https://familysearch.org/en/wiki : accessed 5 November 2022), 19 August 2020, at 15:24.